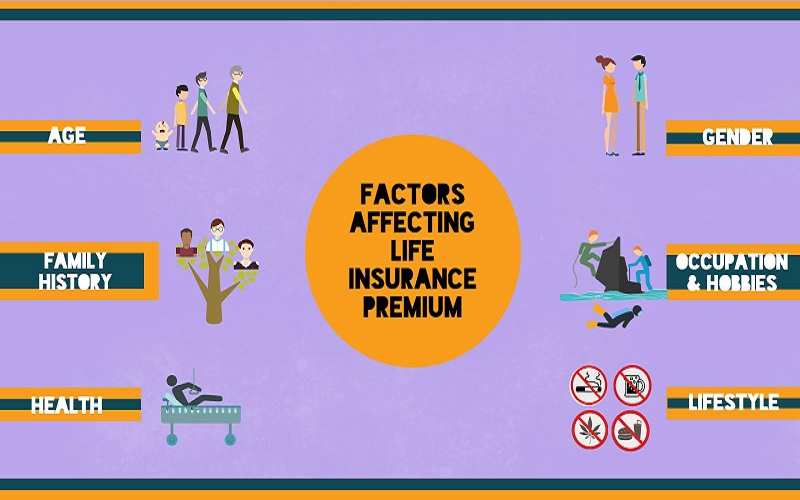

Life insurance is a crucial financial tool that provides financial protection for your loved ones in the event of your death. However, the cost of life insurance can vary significantly from person to person, depending on various factors. Understanding these factors can help you make informed decisions when choosing a life insurance policy. In this blog post, we will explore 10 key factors that can influence your life insurance premium.

- Age: Age is one of the most significant factors affecting life insurance premiums. Generally, younger individuals are considered lower risk, and as a result, they often pay lower premiums. As you age, the likelihood of health issues and mortality increases, leading to higher premiums.

- Health History: Your overall health plays a crucial role in determining your life insurance premium. Insurers assess your medical history, including pre-existing conditions, family medical history, and lifestyle choices. Individuals with a clean bill of health typically qualify for lower premiums.

- Lifestyle Choices: Certain lifestyle choices, such as smoking, excessive alcohol consumption, or engaging in high-risk activities, can raise your life insurance premiums. Insurers consider these factors as they impact your overall health and life expectancy.

- Occupation: Your occupation can influence your life insurance premium. Jobs with higher risks of injury or exposure to hazardous conditions may result in higher premiums. Those with desk jobs or low-risk occupations generally enjoy lower premium rates.

- Gender: Statistically, women tend to live longer than men. Consequently, women often pay lower life insurance premiums compared to men of the same age and health status.

- Coverage Amount: The amount of coverage you choose significantly affects your premium. Higher coverage amounts mean higher premiums. It’s essential to strike a balance between adequate coverage and affordability based on your financial situation.

- Policy Type: The type of life insurance policy you choose—whether term, whole life, or universal life—impacts your premium. Term life insurance typically has lower initial premiums, while permanent life insurance options may have higher upfront costs.

- Term Length: If you opt for a term life insurance policy, the length of the term also affects your premium. Longer terms generally result in higher premiums, as the insurer assumes a greater risk over an extended period.

- Medical Exams: Some life insurance policies require a medical examination. The results of these exams can influence your premium. A clean bill of health may lead to lower premiums, while underlying health issues may result in higher costs.

- Credit Score: In some cases, your credit score can impact your life insurance premium. Insurers use credit information to assess your financial stability and responsibility. A higher credit score may result in lower premiums.

Conclusion:

When purchasing life insurance, it’s crucial to be aware of the various factors that can affect your premium. By understanding these influences, you can make informed decisions that align with your financial goals and provide the best possible protection for your loved ones. It’s advisable to consult with an insurance professional to navigate the complexities of life insurance and find a policy that meets your needs and budget